- Latest available (Revised)

- Point in Time (17/07/2012)

- Original (As enacted)

Finance Act 2003

You are here:

- UK Public General Acts

- 2003 c. 14

- SCHEDULE 5

- Show Geographical Extent(e.g. England, Wales, Scotland and Northern Ireland)

- Show Timeline of Changes

Changes over time for: SCHEDULE 5

Version Superseded: 15/09/2016

Status:

Point in time view as at 17/07/2012.

Changes to legislation:

Finance Act 2003, SCHEDULE 5 is up to date with all changes known to be in force on or before 28 May 2024. There are changes that may be brought into force at a future date. Changes that have been made appear in the content and are referenced with annotations.![]()

Changes to Legislation

Changes and effects yet to be applied by the editorial team are only applicable when viewing the latest version or prospective version of legislation. They are therefore not accessible when viewing legislation as at a specific point in time. To view the ‘Changes to Legislation’ information for this provision return to the latest version view using the options provided in the ‘What Version’ box above.

Section 56

SCHEDULE 5U.K.Stamp duty land tax: amount of tax chargeable: rent

IntroductionU.K.

1U.K.This Schedule provides for calculating the tax chargeable—

(a)in respect of a chargeable transaction for which the chargeable consideration consists of or includes rent, or

(b)where such a transaction is to be taken into account as a linked transaction.

[F1Amounts payable in respect of periods before grant of leaseU.K.

Textual Amendments

F1Sch. 5 para. 1A and cross-heading inserted (with effect in accordance with Sch. 39 para. 13(3)-(6) of the amending Act) by Finance Act 2004 (c. 12), Sch. 39 para. 10

1AU.K.For the purposes of this Part “rent” does not include any chargeable consideration for the grant of a lease that is payable in respect of a period before the grant of the lease.]

Calculation of tax chargeable in respect of rentU.K.

2(1)Tax is chargeable under this Schedule in respect of so much of the chargeable consideration as consists of rent.U.K.

[F2(2)The tax chargeable is the total of the amounts produced by taking the relevant percentage of so much of the relevant rental value as falls within each rate band.

(3)The relevant percentages and rate bands are determined by reference to whether the relevant land—

(a)consists entirely of residential property (in which case Table A below applies), or

(b)consists of or includes land that is not residential property (in which case Table B below applies).

TABLE B: NON-RESIDENTIAL OR MIXED

| Rate bands | Percentage |

|---|---|

| £0 to £150,000 | 0% |

| Over £150,000 | 1% |

(4)For the purposes of sub-paragraphs (2) and (3)—

(a)the relevant rental value is the net present value of the rent payable over the term of the lease, and

(b)the relevant land is the land that is the subject of the lease.

(5)If the lease in question is one of a number of linked transactions for which the chargeable consideration consists of or includes rent, the above provisions are modified.

(6)In that case the tax chargeable is determined as follows.

First, calculate the amount of the tax that would be chargeable if the linked transactions were a single transaction, so that—

(a)the relevant rental value is the total of the net present values of the rent payable over the terms of all the leases, and

(b)the relevant land is all land that is the subject of any of those leases.

Then, multiply that amount by the fraction:

where—

NPV is the net present value of the rent payable over the term of the lease in question, and

TNPV is the total of the net present values of the rent payable over the terms of the all the leases.]

Textual Amendments

F2Sch. 5 para. 2(2)-(6) substituted for Sch. 5 para. 2(2)-(5) (1.12.2003) by The Stamp Duty Land Tax (Amendment of Schedule 5 to the Finance Act 2003) Regulations 2003 (SI 2003/2914), reg. 2 Sch. para. 1

F3Sum in Sch. 5 para. 2(3) substituted (with effect in accordance with s. 162(4) of the amending Act) by Finance Act 2006 (c. 25), s. 162(2)

Modifications etc. (not altering text)

C1Sch. 5 para. 2(3) modified (temp.) (21.7.2009) by Finance Act 2009 (c. 10), s. 10(1)

Net present value of rent payable over term of leaseU.K.

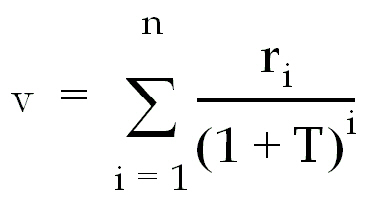

3U.K.The net present value (v) of the rent payable over the term of a lease is calculated by applying the formula:

where—

Textual Amendments

F4Words in Sch. 5 para. 3 repealed (with effect in accordance with Sch. 39 para. 26 of the amending Act) by Finance Act 2004 (c. 12), Sch. 42 Pt. 4(2) (which amending provision re-enacts, subject to certain changes, a corresponding amendment made by the now revoked Stamp Duty and Stamp Duty Land Tax (Variation of the Finance Act 2003) (No. 2) Regulations 2003 (S.I. 2003/2816), see Sch. 39 para. 14)

F5Words in Sch. 5 para. 3 substituted (with effect in accordance with s. 164(4) of the amending Act) by Finance Act 2006 (c. 25), s. 164(2)

Rent payableU.K.

F64U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F6Sch. 5 paras. 4-7 repealed (with effect in accordance with Sch. 39 para. 26 of the amending Act) by Finance Act 2004 (c. 12), Sch. 42 Pt. 4(2) (which amending provision re-enacts, subject to certain changes, a corresponding amendment made by the now revoked Stamp Duty and Stamp Duty Land Tax (Variation of the Finance Act 2003) (No. 2) Regulations 2003 (S.I. 2003/2816), see Sch. 39 para. 14)

Effect of provision for rent reviewU.K.

F65U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F6Sch. 5 paras. 4-7 repealed (with effect in accordance with Sch. 39 para. 26 of the amending Act) by Finance Act 2004 (c. 12), Sch. 42 Pt. 4(2) (which amending provision re-enacts, subject to certain changes, a corresponding amendment made by the now revoked Stamp Duty and Stamp Duty Land Tax (Variation of the Finance Act 2003) (No. 2) Regulations 2003 (S.I. 2003/2816), see Sch. 39 para. 14)

Term of leaseU.K.

F66U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F6Sch. 5 paras. 4-7 repealed (with effect in accordance with Sch. 39 para. 26 of the amending Act) by Finance Act 2004 (c. 12), Sch. 42 Pt. 4(2) (which amending provision re-enacts, subject to certain changes, a corresponding amendment made by the now revoked Stamp Duty and Stamp Duty Land Tax (Variation of the Finance Act 2003) (No. 2) Regulations 2003 (S.I. 2003/2816), see Sch. 39 para. 14)

Treatment of lease for indefinite termU.K.

F67U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F6Sch. 5 paras. 4-7 repealed (with effect in accordance with Sch. 39 para. 26 of the amending Act) by Finance Act 2004 (c. 12), Sch. 42 Pt. 4(2) (which amending provision re-enacts, subject to certain changes, a corresponding amendment made by the now revoked Stamp Duty and Stamp Duty Land Tax (Variation of the Finance Act 2003) (No. 2) Regulations 2003 (S.I. 2003/2816), see Sch. 39 para. 14)

Temporal discount rateU.K.

8(1)For the purposes of this Schedule the “temporal discount rate” is 3.5% or such other rate as may be specified by regulations made by the Treasury.U.K.

(2)Regulations under this paragraph may make any such provision as is mentioned in subsection (3)(b) to (f) of section 178 of the Finance Act 1989 (c. 26) (power of Treasury to set rates of interest).

(3)Subsection (5) of that section (power of Inland Revenue to specify rate by order in certain circumstances) applies in relation to regulations under this paragraph as it applies in relation to regulations under that section.

Tax chargeable in respect of consideration other than rent [F7: general] U.K.

Textual Amendments

F7Word in Sch. 5 para. 9 heading inserted (with effect in accordance with s. 95(13) of the amending Act) by Finance Act 2008 (c. 9), s. 95(2)

9(1)Where in the case of a transaction to which this Schedule applies there is chargeable consideration other than rent, the provisions of this Part apply in relation to that consideration as in relation to other chargeable consideration [F8(but see paragraph 9A)].U.K.

F9(2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F10(2A). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F11(3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(4)Tax chargeable under this Schedule is in addition to any tax chargeable under section 55 [F12or 74(1A)] [F13or Schedule [F144A or] 6B] in respect of consideration other than rent.

(5)Where a transaction to which this Schedule applies falls to be taken into account for the purposes of [F15section 55] [F16or Schedule] [F176B] as a linked transaction, no account shall be taken of rent in determining the relevant consideration.

Textual Amendments

F8Words in Sch. 5 para. 9(1) inserted (with effect in accordance with s. 95(13) of the amending Act) by Finance Act 2008 (c. 9), s. 95(2)(a)

F9Sch. 5 para. 9(2) omitted (with effect in accordance with s. 95(13) of the amending Act) by virtue of Finance Act 2008 (c. 9), s. 95(2)(b)

F10Sch. 5 para. 9(2A) omitted (with effect in accordance with s. 95(13) of the amending Act) by virtue of Finance Act 2008 (c. 9), s. 95(2)(b)

F11Sch. 5 para. 9(3) omitted (with effect in accordance with s. 95(13) of the amending Act) by virtue of Finance Act 2008 (c. 9), s. 95(2)(b)

F12Words in Sch. 5 para. 9(4) inserted (with effect in accordance with Sch. 35 para. 10 of the amending Act) by Finance Act 2012 (c. 14), Sch. 35 para. 7(2)(a)(i)

F13Words in Sch. 5 para. 9(4) inserted (with effect in accordance with Sch. 22 para. 9 of the amending Act) by Finance Act 2011 (c. 11), Sch. 22 para. 6(a)

F14Words in Sch. 5 para. 9(4) inserted (with effect in accordance with Sch. 35 para. 10 of the amending Act) by Finance Act 2012 (c. 14), Sch. 35 para. 7(2)(a)(ii)

F15Words in Sch. 5 para. 9(5) substituted (with effect in accordance with Sch. 35 para. 10 of the amending Act) by Finance Act 2012 (c. 14), Sch. 35 para. 7(2)(b)(i)

F16Words in Sch. 5 para. 9(5) inserted (with effect in accordance with Sch. 22 para. 9 of the amending Act) by Finance Act 2011 (c. 11), Sch. 22 para. 6(b)

F17Words in Sch. 5 para. 9(5) inserted (with effect in accordance with Sch. 35 para. 10 of the amending Act) by Finance Act 2012 (c. 14), Sch. 35 para. 7(2)(b)(ii)

[F18Tax chargeable in respect of consideration other than rent: 0% bandU.K.

Textual Amendments

F18Sch. 5 para. 9A and cross-heading inserted (with effect in accordance with s. 95(13) of the amending Act) by Finance Act 2008 (c. 9), s. 95(3)

9A(1)This paragraph applies in the case of a transaction to which this Schedule applies [F19where— U.K.

(a)there is chargeable consideration other than rent, and

(b)section 55 (amount of tax chargeable: general) applies to the transaction (whether as a result of paragraph 2 of Schedule 4A or otherwise).]

(2)If—

(a)the relevant land consists entirely of land that is non-residential property, and

(b)the relevant rent is at least £1,000,

the 0% band in Table B in section 55(2) does not apply in relation to the consideration other than rent and any case that would have fallen within that band is treated as falling within the 1% band.

(3)Sub-paragraphs (4) and (5) apply if—

(a)the relevant land is partly residential property and partly non-residential property, and

(b)the relevant rent attributable, on a just and reasonable apportionment, to the land that is non-residential property is at least £1,000.

(4)For the purpose of determining the amount of tax chargeable under section 55 in relation to the consideration other than rent, the transaction (or, where it is one of a number of linked transactions, that set of transactions) is treated as if it were two separate transactions (or sets of linked transactions), namely—

(a)one whose subject-matter consists of all of the interests in land that is residential property, and

(b)one whose subject-matter consists of all of the interests in land that is non-residential property.

(5)For that purpose, the chargeable consideration attributable to each of those separate transactions (or sets of linked transactions) is the chargeable consideration so attributable on a just and reasonable apportionment.

(6)In this paragraph “the relevant rent” means—

(a)the annual rent in relation to the transaction in question, or

(b)if that transaction is one of a number of linked transactions for which the chargeable consideration consists of or includes rent, the total of the annual rents in relation to all of those transactions.

(7)In sub-paragraph (6) the “annual rent” means the average annual rent over the term of the lease or, if—

(a)different amounts of rent are payable for different parts of the term, and

(b)those amounts (or any of them) are ascertainable at the effective date of the transaction,

the average annual rent over the period for which the highest ascertainable rent is payable.

(8)In this paragraph “relevant land” has the meaning given in section 55(3) and (4).]

Textual Amendments

F19Words in Sch. 5 para. 9A(1) substituted (with effect in accordance with Sch. 35 para. 10 of the amending Act) by Finance Act 2012 (c. 14), Sch. 35 para. 7(3)

Increase of rent treated as grant of new leaseU.K.

F2010U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F20Sch. 5 para. 10 repealed (with effect in accordance with Sch. 39 para. 26 of the amending Act) by Finance Act 2004 (c. 12), Sch. 42 Pt. 4(2) (which amending provision re-enacts, subject to certain changes, a corresponding amendment made by the now revoked Stamp Duty and Stamp Duty Land Tax (Variation of the Finance Act 2003) (No. 2) Regulations 2003 (S.I. 2003/2816), see Sch. 39 para. 14)

InterpretationU.K.

F2111U.K.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Textual Amendments

F21Sch. 5 para. 11 repealed (with effect in accordance with Sch. 39 para. 26 of the amending Act) by Finance Act 2004 (c. 12), Sch. 42 Pt. 4(2) (which amending provision re-enacts, subject to certain changes, a corresponding amendment made by the now revoked Stamp Duty and Stamp Duty Land Tax (Variation of the Finance Act 2003) (No. 2) Regulations 2003 (S.I. 2003/2816), see Sch. 39 para. 14)

Options/Help

Print Options

PrintThe Whole Act

PrintThis Schedule only

You have chosen to open The Whole Act

The Whole Act you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

You have chosen to open The Whole Act as a PDF

The Whole Act you have selected contains over 200 provisions and might take some time to download.

Would you like to continue?

You have chosen to open the Whole Act

The Whole Act you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

You have chosen to open the Whole Act without Schedules

The Whole Act without Schedules you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

You have chosen to open Schedules only

The Schedules you have selected contains over 200 provisions and might take some time to download. You may also experience some issues with your browser, such as an alert box that a script is taking a long time to run.

Would you like to continue?

Legislation is available in different versions:

Latest Available (revised):The latest available updated version of the legislation incorporating changes made by subsequent legislation and applied by our editorial team. Changes we have not yet applied to the text, can be found in the ‘Changes to Legislation’ area.

Original (As Enacted or Made): The original version of the legislation as it stood when it was enacted or made. No changes have been applied to the text.

Point in Time: This becomes available after navigating to view revised legislation as it stood at a certain point in time via Advanced Features > Show Timeline of Changes or via a point in time advanced search.

See additional information alongside the content

Geographical Extent: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Show Timeline of Changes: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

More Resources

Access essential accompanying documents and information for this legislation item from this tab. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as enacted version that was used for the print copy

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- correction slips

- links to related legislation and further information resources

Timeline of Changes

This timeline shows the different points in time where a change occurred. The dates will coincide with the earliest date on which the change (e.g an insertion, a repeal or a substitution) that was applied came into force. The first date in the timeline will usually be the earliest date when the provision came into force. In some cases the first date is 01/02/1991 (or for Northern Ireland legislation 01/01/2006). This date is our basedate. No versions before this date are available. For further information see the Editorial Practice Guide and Glossary under Help.

More Resources

Use this menu to access essential accompanying documents and information for this legislation item. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as enacted version that was used for the print copy

- correction slips

Click 'View More' or select 'More Resources' tab for additional information including:

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- links to related legislation and further information resources