- Latest available (Revised)

- Point in Time (01/03/2019)

- Original (As made)

The Solvency 2 Regulations 2015

You are here:

- UK Statutory Instruments

- 2015 No. 575

- Schedules only

- Show Geographical Extent(e.g. England, Wales, Scotland and Northern Ireland)

- Show Timeline of Changes

More Resources

Changes over time for: The Solvency 2 Regulations 2015 (Schedules only)

Version Superseded: 31/12/2020

Alternative versions:

- 31/03/2015- Amendment

- 01/01/2016- Amendment

- 01/03/2019

Point in time - 31/12/2020- Amendment

Status:

Point in time view as at 01/03/2019.

Changes to legislation:

There are currently no known outstanding effects for the The Solvency 2 Regulations 2015.![]()

Changes to Legislation

Revised legislation carried on this site may not be fully up to date. At the current time any known changes or effects made by subsequent legislation have been applied to the text of the legislation you are viewing by the editorial team. Please see ‘Frequently Asked Questions’ for details regarding the timescales for which new effects are identified and recorded on this site.

Regulation 59

SCHEDULE 1U.K.Amendments to primary legislation

PART 1 U.K.Amendments to FSMA

1. FSMA is amended as follows.U.K.

2.—(1) Section 55J (variation or cancellation on initiative of regulator) is amended as follows.U.K.

(2) After subsection (7), insert—

“(7A) Without prejudice to the generality of subsections (1) and (3), if it appears to the PRA that there has been a serious failure by a PRA-authorised person who is an insurance undertaking or reinsurance undertaking to comply with requirements imposed by or under this Act in pursuance of the Solvency 2 Directive, the PRA may exercise its powers under this section to cancel the undertaking's Part 4A permission.

(7B) If it appears to the PRA that the conditions in section 55KA are met in relation to a PRA-authorised person who is an insurance undertaking, reinsurance undertaking or third-country insurance undertaking, the PRA must—

(a)in relation to the undertaking's Part 4A permission so far as the permission relates to the regulated activity of effecting contracts of insurance as principal (“activity A”), exercise the PRA's powers under this section by varying the permission—

(i)where the permission relates to activity A in relation to both contracts of long-term insurance and contracts of general insurance and the conditions in section 55KA are met only in relation to the business of the undertaking so far as relating to contracts of one of those kinds, so as to remove activity A so far as relating to contracts of that kind from the regulated activities to which the permission relates, and

(ii)in any other case, so as to remove activity A from the regulated activities to which the permission relates;

(b)in relation to the undertaking's Part 4A permission so far as the permission relates to the regulated activity of carrying out contracts of insurance as principal (“activity B”), exercise the PRA's powers under this section, if it appears to the PRA to be necessary to do so to protect the interests of the undertaking's policyholders, by varying the Part 4A permission—

(i)where the permission relates to activity B in relation to both contracts of long-term insurance and contracts of general insurance and the conditions in section 55KA are met only in relation to the business of the undertaking so far as relating to contracts of one of the those kinds, so as to remove activity B so far as relating to contracts of that kind from the regulated activities to which the permission relates, and

(ii)in any other case, so as to remove activity B from the regulated activities to which the permission relates.

(7C) If the effect of a variation required by subsection (7B) is to remove all the regulated activities to which the Part 4A permission relates, the PRA must instead cancel the permission.”.

3. After section 55K (investment firms: particular conditions that enable cancellation), insert—U.K.

“55KA. Insurance undertakings, reinsurance undertakings and third-country insurance undertakings: particular conditions that enable cancellation

(1) The conditions referred to in section 55J(7B) are—

(a)that the insurance undertaking, reinsurance undertaking or third-country insurance undertaking has failed to comply with the appropriate capital requirement; and

(b)that any of the following applies—

(i)the insurance undertaking, reinsurance undertaking or third-country insurance undertaking has failed to submit a finance scheme in accordance with requirements imposed by or under this Act in pursuance of Article 139(2) of the Solvency 2 Directive, or of that provision with Article 74(7) of that directive;

(ii)the insurance undertaking, reinsurance undertaking or third-country insurance undertaking has submitted to the PRA a finance scheme that is manifestly inadequate; or

(iii)after the PRA has approved a finance scheme submitted to it, the undertaking has failed to comply with the finance scheme within a period of three months beginning with the date when the undertaking first became aware that it had failed to comply with the appropriate capital requirement to which the scheme relates.

(2) In subsection (1) “the appropriate capital requirement” means—

(a)except in a case within paragraph (b) or (c), the minimum capital requirement;

(b)in the case of an insurance undertaking or reinsurance undertaking whose Part 4A permission relates to both contracts of long-term insurance and to contracts of general insurance, requirements imposed by or under this Act in pursuance of Article 74(2) of the Solvency 2 Directive;

(c)in the case of a third-country insurance undertaking whose Part 4A permission relates both to contracts of long-term insurance and to contracts of general insurance, requirements imposed by or under this Act in pursuance of Articles 74(2) and 166 of the Solvency 2 Directive.”.

4. After section 55P (prohibitions and restrictions), insert—U.K.

“55PA. Assets requirements imposed on insurance undertakings or reinsurance undertakings

(1) If either of the following cases arises in relation to an insurance undertaking, reinsurance undertaking or third-country insurance undertaking, the PRA must inform the supervisory authority of each host EEA State of that undertaking.

(2) The first case is where the PRA intends to impose an assets requirement on the undertaking because the undertaking has not complied with rules implementing Section 2 of Chapter 6 of Title 1 of the Solvency 2 Directive.

(3) The second case is where—

(a)the undertaking has notified the PRA that—

(i)the undertaking does not comply with the solvency capital requirement, or

(ii)there is a risk that at some time within the next 3 months the undertaking may not comply with the solvency capital requirement, and

(b)because the PRA is of the opinion that the financial situation of the undertaking will deteriorate after the PRA has received the notification, the PRA imposes an assets requirement on the undertaking.

(4) In this section—

(a)“assets requirement” has the same meaning as in section 55P(4); and

(b)“host EEA State” means—

(i)in relation to an insurance undertaking or reinsurance undertaking, an EEA State which is a “host Member State” for the purposes of the Solvency 2 Directive (which is to be determined in accordance with Article 13(9) of that directive);

(ii)in relation to a third-country insurance undertaking, an EEA State other than the United Kingdom from which the undertaking has received authorisation in accordance with Article 162 of the Solvency 2 Directive.”.

5. In section 105 (insurance business transfer schemes), in subsection (3), in paragraph (aa) of Case 2 M1, omit “(within the meaning of Article 2.1(c) of the reinsurance directive)”.U.K.

Marginal Citations

M1Section 105(3)(Case 2)(aa) was inserted by S.I. 2007/3253.

6.—(1) Section 116 (effect of insurance business transfers authorised in other EEA States) is amended as follows.U.K.

(2) In subsection (2) M2—

(a)for paragraphs (a) and (b) substitute—

“(a)an undertaking authorised in an EEA State other than the United Kingdom under Article 162 of the Solvency 2 Directive;

(b)an undertaking whose head office is not in an EEA State and which is authorised under the law of an EEA State other than the United Kingdom to carry out reinsurance activities in its territory (as mentioned in Article 174 of the Solvency 2 Directive).”; and

(b)omit paragraph (c).

(3) For subsections (5) M3 and (6) M4 substitute—

“(5) “Authorised transfer” means—

(a)in subsection (1), a transfer authorised by the supervisory authorities of the home State of the EEA firm in accordance with Article 39 of the Solvency 2 Directive;

(b)in subsection (2), a transfer authorised in an EEA State other than the United Kingdom in accordance with—

(i)Article 164 of the Solvency 2 Directive; or

(ii)the provisions in the law of that EEA State which provide for the authorisation of transfers of all or part of a portfolio of contracts of an undertaking authorised to carry out reinsurance activities in its territory (as mentioned in Article 174 of the Solvency 2 Directive).

(6) “UK policy”, in relation to an authorised transfer, means a policy evidencing a contract of insurance or reinsurance to which the applicable law is the law of a part of the United Kingdom.”.

(4) After subsection (7) insert—

“(7A) In this section the “home State” is the EEA State which is the “home Member State” for the purposes of the Solvency 2 Directive (which is to be determined in accordance with Article 13(8) of that directive).”.

Marginal Citations

M2Section 116(2) was substituted by S.I. 2007/3253.

M3Section 116(5) was amended by S.I. 2004/3379 and S.I. 2007/3253.

M4Section 166(6) was amended by S.I. 2007/3253.

7. In section 165(7) (regulators' power to require information: authorised persons etc), after paragraph (d), insert—U.K.

“(e)by either regulator, to impose requirements on a person who provides any service to an insurance undertaking, reinsurance undertaking or third-country insurance undertaking.”.

8.—(1) Section 167 (appointment of persons to carry out general investigations) is amended as follows.U.K.

(2) In subsection (2)—

(a)at the end of paragraph (a) omit “or”;

(b)at the end of paragraph (b) insert “ ; or; ” and

(c)after paragraph (b) insert—

“(c)where A is an insurance undertaking, reinsurance undertaking or third-country insurance undertaking, a person who provides services to A.”.

(3) After subsection (3), insert—

“(3A) If a person appointed under subsection (1) decides under subsection (2)(c) to investigate a person located in an EEA State other than the United Kingdom the person appointed must inform the supervisory authority of that EEA State prior to conducting an on-site inspection.”.

9. In section 190(4) (requests for further information), for paragraph (b) M5 substitute—U.K.

“(b)is not subject to supervision under—

(i)the UCITS directive;

(ii)the Solvency 2 Directive;

(iii)the markets in financial instruments directive; or

(iv)the capital requirements directive.”.

Marginal Citations

M5Section 190(4)(b) was amended by S.I. 2013/3115.

10. In section 194 (general grounds on which power of intervention is exercisable), after subsection (1A) M6, insert—U.K.

“(1AA) Where an incoming firm is an EEA firm falling within paragraph 5(d) or (da) of Schedule 3, the appropriate regulator must not exercise its power of intervention under subsection (1)(c) in respect of that firm if doing so would, for the purposes of the Solvency 2 Directive, constitute financial supervision of that firm.”.

Marginal Citations

M6Subsection (1A) was inserted by sections 3(1) and 5(a) of the Financial Services Act 2012 (c. 21).

11.—(1) Section 198 (power to apply to court for injunction in respect of certain overseas insurance companies) is amended as follows.U.K.

(2) For subsection (1) substitute—

“(1) This section applies if the appropriate regulator has received a request made in respect of an incoming EEA firm in accordance with Article 140 of the Solvency 2 Directive.”.

(3) In subsection (3A), for “competent authority for the purposes of the provision referred to in subsection (1)(a), (b) or (c)” substitute “ supervisory authority for the purposes of Article 140 of the Solvency 2 Directive ”.

12. In section 316 (direction by a regulator), in subsection (4)(b)(i), for “any of the insurance directives” substitute “ the Solvency 2 Directive ”.U.K.

13. In section 367(3) (winding up petitions), before paragraph (a), insert—U.K.

“(za)in the case of an insurance undertaking or reinsurance undertaking, the PRA has cancelled the body's Part 4A permission pursuant to section 55J(7C);”.

14. In section 405(5) (directions), omit paragraphs (c) and (d).U.K.

15. In section 417 (definitions), in subsection (1), insert at the appropriate place in each case—U.K.

““insurance undertaking” has the meaning given in Article 13(1) of the Solvency 2 Directive;”

““minimum capital requirement” means—

in relation to an insurance undertaking or reinsurance undertaking, requirements imposed by or under this Act in pursuance of Section 5 of Chapter 6 of Title 1 of the Solvency 2 Directive;

in relation to a third-country insurance undertaking, requirements imposed by or under this Act in pursuance of those provisions and Article 166 of the Solvency 2 Directive.”

““reinsurance undertaking” has the meaning given in Article 13(4) of the Solvency 2 Directive;”

““solvency capital requirement” means—

in relation to an insurance undertaking or reinsurance undertaking, requirements imposed by or under this Act in pursuance of Section 4 of Chapter 6 of Title 1 of the Solvency 2 Directive;

in relation to a third-country insurance undertaking, requirements imposed by or under this Act in pursuance of those provisions and Article 166 of the Solvency 2 Directive.”

““third-country insurance undertaking” means an undertaking that has received authorisation under Article 162 of the Solvency 2 Directive from the PRA or the FCA;”.

16. In section 425(1)(a) (expressions relating to authorisation elsewhere in the single market)—U.K.

(a)omit “ “life assurance consolidation directive””, “ “first non-life insurance directive””, “insurance directives” and “reinsurance directive”, and

(b)after “ “single market directives”” insert “ “, Solvency 2 Directive” ”.

17.—(1) Schedule 3 (EEA passport rights) is amended as follows.U.K.

(2) In paragraph 1—

(a)for paragraph (c) substitute—

“(c)the Solvency 2 Directive;”;

(b)omit paragraph (ca).

(3) For paragraph 3 substitute—

“The Solvency 2 Directive

3. “The Solvency 2 Directive” means Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II).”.

(4) Omit paragraph 3A.

(5) In paragraph 5, for paragraphs (d) and (da) substitute—

“(d)an undertaking pursuing the activity of direct insurance (within the meaning of Article 2 of the Solvency 2 Directive) which has received authorisation under Article 14 of that directive from its home state regulator;

(da)an undertaking pursuing the activity of reinsurance (within the meaning of Article 2 of the Solvency 2 Directive) as a reinsurance undertaking which has received authorisation under Article 14 of that directive from its home state regulator;”.

(6) In paragraph 15, for sub-paragraph (6) substitute—

“(6) The permission is to be treated as being on terms equivalent to those appearing in the authorisation granted to the firm under Article 14 of the Solvency 2 Directive by its home state regulator (“its home authorisation”).”.

(7) In paragraph 19—

(a)in sub-paragraphs (5)(b)(i), (7) and (9), for “any of the insurance directives” substitute “ the Solvency 2 Directive ”;

(b)in sub-paragraph (5ZA), for “a UK firm having an EEA right which is subject to the conditions of the reinsurance directive” substitute “ a UK firm which falls within the second sub-paragraph of Article 2(1) of the Solvency 2 Directive ”;

(c)in sub-paragraph (7)(b) for “those directives” substitute “ that directive ”.

(8) In paragraph 20—

(a)in sub-paragraph (1) for “(4F)”, substitute “ (4I) ”;

(b)in sub-paragraphs (3A) and (4B) for “any of the insurance directives” substitute “ the Solvency 2 Directive ”;

(c)in sub-paragraph (4D), for “a UK firm having an EEA right which is subject to the conditions of the reinsurance directive” substitute “ a UK firm which falls within the second sub-paragraph of Article 2(1) of the Solvency 2 Directive ”;

(d)after sub-paragraph (4F) insert—

“(4G) This paragraph does not apply to a UK firm exercising an EEA right to enter into a Community co-insurance contract if it is not the leading insurance undertaking.

(4H) In this paragraph “Community co-insurance contract” means a contract of insurance which—

(a)covers one or more risks that are within any of classes 3 to 16 of Annex I of the Solvency 2 Directive;

(b)covers a large risk situated within the EEA which is not covered in whole or in part by another contract of insurance;

(c)provides that the risk to which it relates is covered by an overall premium and for the same period by two or more insurance undertakings each for its own part as a co-insurer, at least one of which enters into the contract from a head office or branch established in an EEA State other than that of the leading insurance undertaking; and

(d)provides that one of the co-insurers is the leading insurance undertaking.

(4I) In this paragraph—

(a)“leading insurance undertaking” means the insurance undertaking which under the Community co-insurance contract is specified as such and assumes fully the leader's role including in particular—

(i)being treated as covering the whole risk; and

(ii)determining the terms and conditions of insurance and rating;

(b)“large risk” has the meaning given in Article 13(27) of the Solvency 2 Directive but as if the risks referred to in point (c) of the first sub-paragraph of Article 13(27) included risks insured by professional associations, joint ventures, or temporary groupings.”.

18.—(1) Schedule 12 (transfer schemes: certificates) is amended as follows.U.K.

(2) In paragraph 1—

(a)after sub-paragraph (1)(b) insert—

“(ba)if sub-paragraph (2A) applies, a certificate under paragraph 3A.”;

(b)in sub-paragraph (2) for “Article 4 of the life assurance consolidation directive or Article 6 of the first non-life insurance directive” substitute “ Article 14 of the Solvency 2 Directive ”;

(c)after sub-paragraph (2) insert—

“(2A) This sub-paragraph applies if—

(a)the transferor concerned is a UK authorised person which has received authorisation under Article 14 of the Solvency 2 Directive from the appropriate regulator; and

(b)as regards any policy which is included in the proposed transfer and which evidences a contract of insurance (other than reinsurance), the contract was concluded in an EEA State other than the United Kingdom.”;

(d)in sub-paragraph (3)(a) for “Article 4 or Article 51 of the life assurance consolidation directive” substitute “ Article 162 of the Solvency 2 Directive ”;

(e)in sub-paragraph (4)(a) for “Article 6 or Article 23 of the first non-life insurance directive” substitute “ Article 162 of the Solvency 2 Directive ”;

(f)in sub-paragraph (5), for paragraphs (a) and (b) substitute—

“(a)the transferor concerned has received authorisation under Article 162 of the Solvency 2 Directive from the appropriate regulator; and

(b)the proposed transfer is to a branch or agency, in an EEA State other than the United Kingdom, authorised under that Article.”.

(3) In paragraph 2—

(a)for sub-paragraph (6)(aa) substitute—

“(aa)if the transferee is a non-EEA branch, the supervisory authority of the EEA State in which the transferee is situated or, where appropriate, the supervisory authority of an EEA State which supervises the state of solvency of the entire business of the transferee's agencies and branches within the EEA in accordance with Article 167 of the Solvency 2 Directive;”;

(b)for sub-paragraph (7A), substitute—

“(7A) “Supervisory authority” has the same meaning as in the Solvency 2 Directive.”;

(c)for sub-paragraph (9), substitute—

“(9) “Non-EEA branch” means a branch or agency which has received authorisation under Article 162 of the Solvency 2 Directive.”.

(4) In the heading to paragraph 3, for “consent” substitute “ consultation ”.

(5) After paragraph 3 insert—

“Certificates as to consentU.K.

3A. A certificate under this paragraph is one given by the appropriate regulator and certifying that in respect of each contract concluded in an EEA State other than the United Kingdom the authority responsible for supervising persons who effect or carry out contracts of insurance in the EEA State in which that contract was concluded has been notified of the proposed scheme and that—

(a)the authority has consented to the proposed scheme; or

(b)the authority has not responded but the period of three months beginning with the notification has elapsed.”.

(6) For paragraph 5A(4) substitute—

“(4) “Relevant authority” means the supervisory authority (within the meaning of the Solvency 2 Directive) of the EEA State in which the transferee is set up.”.

(7) In paragraph 10—

(a)for sub-paragraph (3) substitute—

“(3) The transferor is a company authorised in an EEA State other than the United Kingdom under Article 162 of the Solvency 2 Directive and the transferee is a UK authorised person which has received authorisation under Article 14 of the Solvency 2 Directive.”;

(b)for sub-paragraph (4) substitute—

“(4) The transferor is a Swiss general insurer and the transferee is a UK authorised person which has received authorisation under Article 14 of the Solvency 2 Directive.”.

PART 2 U.K.Amendments to other primary legislation

Friendly Societies Act 1992U.K.

19.—(1) The Friendly Societies Act 1992 M7 is amended as follows.

(2) In section 52(2)(c)(i) (applications to court) for “the general insurance or the life assurance consolidation Directive” substitute “ the Solvency 2 Directive ”.

(3) In subsection (1) of section 119 (general interpretation)—

(a)omit the following definitions—

(i)“the life assurance consolidation Directive”;

(ii)“the first general insurance Directive”;

(iii)“the general insurance Directives”;

(iv)“the second general insurance Directive”;

(v)“the third general insurance Directive”;

(b)insert at the appropriate place—

““the Solvency 2 Directive” means Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II);”.

(4) Omit subsections (1A), (1D) and (3) of section 119.

(5) In Schedule 15 (amalgamations, transfers of engagements and conversion: supplementary)—

(a)in paragraph 15(1)(c)(vi) for “Article 25 or 26 of the first general insurance Directive” substitute “ Article 166 or 167 of the Solvency 2 Directive ”;

(b)in paragraph 15A(1)(c)(v) for “Article 55 or 56 of the life assurance consolidation Directive” substitute “ Article 166 or 167 of the Solvency 2 Directive ”.

Marginal Citations

Finance Act 1997U.K.

20.—(1) Section 96 (demutualisation of insurance companies) of the Finance Act 1997 M8 is amended as follows.

(2) In subsection (7)(b) for the words from “for the purposes of—” to the end of the paragraph substitute “ for the purposes of Article 39 of the Solvency 2 Directive. ”.

(3) In subsection (8)—

(a)omit the following definitions—

(i)“the life assurance consolidation directive”;

(ii)“the third non-life insurance directive”;

(b)insert at the appropriate place—

““the Solvency 2 Directive” means Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II);”.

Marginal Citations

Terrorism Act 2000U.K.

21.—(1) The Terrorism Act 2000 M9 is amended as follows.

(2) In Schedule 3A (regulated sector and supervisory authorities)—

(a)in paragraph 1(1)(c) for “the Life Assurance Consolidation Directive” substitute “ the Solvency 2 Directive ”;

(b)in paragraph 3(1)—

(i)omit the following definition—

“the Life Assurance Consolidation Directive”;

(ii)insert at the appropriate place—

““the Solvency 2 Directive” means Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II).”.

(3) In paragraph 6(1)(i) of Schedule 6 (financial information) for “Article 4 or 51 of Directive 2002/83/EC of the European Parliament and of the Council of 5th November 2002 concerning life assurance” substitute “ Article 14 or 162 of Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) ”.

Marginal Citations

Capital Allowances Act 2001U.K.

22. In section 560(5)(e) (transfer of insurance company business) of the Capital Allowances Act 2001 M10, for “Article 14 of the Council Directive of 5 November 2002 concerning life assurance (2002/83/EC)” substitute “ Article 39 of Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) ”.

Proceeds of Crime Act 2002U.K.

23.—(1) Schedule 9 to the Proceeds of Crime Act 2002 M11 is amended as follows.

(2) In paragraph 1(1)(c) for “the Life Assurance Directive” substitute “ the Solvency 2 Directive ”.

(3) In paragraph 3(1)—

(a)omit the definition of “the Life Assurance Consolidation Directive”;

(b)insert at the appropriate place—

““the Solvency 2 Directive” means Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II);”.

Marginal Citations

Finance Act 2003U.K.

24.—(1) Section 63 (demutualisation of insurance company) of the Finance Act 2003 M12 is amended as follows.

(2) For paragraph (b) of subsection (2) substitute—

“(b)it is a transfer of business of a general insurance company carried on through a permanent establishment in the United Kingdom and takes place in accordance with authorisation granted outside the United Kingdom for the purposes of the Solvency 2 Directive, and the requirements of subsection (3) and (4) are met in relation to the shares of a company (“the issuing company”) which is either the acquiring company or a company of which the acquiring company is a wholly-owned subsidiary.”.

(3) In subsection (7) omit the following definitions—

(a)“the life assurance Directive”;

(b)“the 3rd non-life insurance Directive”.

(4) In subsection (7) insert at the end—

““the Solvency 2 Directive” means Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II).”.

Marginal Citations

Companies Act 2006U.K.

25. In section 843(8) (realised profits and losses of long-term insurance business) of the Companies Act 2006 M13, for “Article 2.1(p) of Directive 2005/68/EC of the European Parliament and of the Council of 16 November 2005 on reinsurance and amending Council Directives 73/239/EEC, 92/49/EEC as well as Directives 98/78/EC and 2002/83/EC” substitute “ Article 13(26) of Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) ”.

Marginal Citations

Corporation Tax Act 2009U.K.

26.—(1) The Corporation Tax Act 2009 M14 is amended as follows.

(2) In section 337(3A) (transfers of loans on insurance business transfers), for “Article 14 of the Council Directive of 5 November 2002 concerning life assurance (2002/83/EC)” substitute “ Article 39 of Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) ”.

(3) In section 636(3) (modifications of Chapter 5), for “Article 14 of the Council Directive of 5 November 2002 concerning life assurance (2002/83/EC)” substitute “ Article 39 of Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) ”.

Regulation 60

SCHEDULE 2U.K.Amendments to secondary legislation

Insolvency (Scotland) Rules 1986U.K.

1. In rule 4.84(8) (application for confirmation) of the Insolvency (Scotland) Rules 1986 M15 for “Articles 9 and 27 of Directive 2001/17/EC of the European Parliament and of the Council of 19th March 2001 on the reorganisation and winding up of insurance undertakings” substitute “ Articles 274 and 293 of Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) ”.

Marginal Citations

M15S.I. 1986/1915, amended by S.I. 2003/2109; there are other amending instruments but none is relevant.

Companies (1986 Order) (Insurance Companies Accounts) Regulations (Northern Ireland) 1994U.K.

2.—(1) The Companies (1986 Order) (Insurance Companies Accounts) Regulations (Northern Ireland) 1994 M16 are amended as follows.

(2) In paragraph (2)(a) of regulation 6 (exempted companies) for “Council Directive 73/239/EEC by Article 3 of that Directive” substitute “ Article 7 of Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) ”.

Marginal Citations

Mineworkers' Pension Scheme (Modification) Regulations 1994U.K.

3.—(1) The Mineworkers' Pension Scheme (Modification) Regulations 1994 M17 are amended as follows.

(2) In clause 41(2) (the scheme: interpretation) of the part headed “The Scheme” of the Mineworkers' Pension Scheme in the Schedule, in the definition of “Recognised Insurance Company” for “Article 4 or Article 51 of Directive 2002/83/EC of the European Parliament and of the Council of 5th November 2002 concerning life assurance” substitute “ Article 14 or 162 of Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) ”.

Marginal Citations

M17S.I. 1994/2577; relevant amending instruments are S.I. 2004/3379 and 2011/1043.

Industry-Wide Mineworkers' Pension Scheme Regulations 1994U.K.

4.—(1) The Industry-Wide Mineworkers' Pension Scheme Regulations 1994 M18 are amended as follows.

(2) In clause 41 ( trust deed: interpretation) of the part headed “The Trust Deed” of the Industry-Wide Mineworkers' Pension Scheme in the Schedule, in the definition of “Recognised Insurance Company” for “Article 4 or Article 51 of Directive 2002/83/EC of the European Parliament and of the Council of 5th November 2002 concerning life assurance” substitute “ Article 14 or 162 of Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) ”.

Marginal Citations

M18S.I. 1994/2974; relevant amending instruments are S.I. 2011/1043 and 2004/3379.

Insurance Companies (Overseas Life Assurance Business) (Compliance) Regulations 1995U.K.

5.—(1) The Insurance Companies (Overseas Life Assurance Business) (Compliance) Regulations 2004 M19 are amended as follows.

(2) In regulation 2 (interpretation), in paragraph (1)—

(a)omit the definition of “the Consolidated Life Assurance Directive”;

(b)insert at the appropriate place—

““the Solvency 2 Directive” means Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II);”.

(3) In the following regulations for “Article 14 or 53(2) of the Consolidated Life Assurance Directive” substitute “ Article 39 or 167 of the Solvency 2 Directive ”

(a)5(1B)(a) (business other than reinsurance business effected by a company resident in the United Kingdom outside the United Kingdom);

(b)7(1B)(a) (business other than reinsurance business effected either by a company resident in the United Kingdom otherwise than outside the United Kingdom or by an overseas life insurance company—policies or contracts made on or after 1st January 1996);

(c)7A(2A)(a) (business other than reinsurance business effected either by a company resident in the United Kingdom otherwise than outside the United Kingdom or by an overseas life insurance company—policy holder not within regulation 7);

(d)8(1B)(a) (certain business other than reinsurance business where the company comes into possession of additional information);

(e)13(1B)(a) (business other than reinsurance business effected by a company resident in the United Kingdom outside the United Kingdom);

(f)14(1B)(a) (business other than reinsurance business effected either by a company resident in the United Kingdom otherwise than outside the United Kingdom or by an overseas life insurance company);

(g)14A(2A)(a) (business other than reinsurance business effected either by a company resident in the United Kingdom otherwise than outside the United Kingdom or by an overseas life insurance company—policy holder not within regulation 7).

Marginal Citations

M19S.I. 1995/3237, amended by S.I. 2004/3273; there are other amending instruments but none is relevant.

Occupational Pension Schemes (Scheme Administration) Regulations 1996U.K.

6.—(1) The Occupational Pension Schemes (Scheme Administration) Regulations 1996 M20 are amended as follows.

(2) In regulation 1(2) (interpretation)—

(a)omit the definition of “the Life Directive”;

(b)insert at the appropriate place—

““the Solvency 2 Directive” means Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II);”;

(c)in the definition of “insurance policy” for “Article 2 of the Life Directive, but excluding a contract of a kind referred to in Article 2(2)(c) or (d) of that Directive” substitute “ Article 2(3) of the Solvency 2 Directive, but excluding a contract of a kind referred to in Article 2(3)(b)(iii) or (iv) of that Directive ”;

(d)in the definition of “qualifying insurance policy” for “Annex I to the Life Directive” substitute “ Annex II of the Solvency 2 Directive ”.

Marginal Citations

M20S.I. 1996/1715, amended by S.I. 2006/778; there are other amending instruments but none is relevant.

Occupational Pension Schemes (Scheme Administration) Regulations (Northern Ireland) 1997U.K.

7.—(1) The Occupational Pension Schemes (Scheme Administration) Regulations (Northern Ireland) 1997 M21 are amended as follows.

(2) In regulation 1 (interpretation), in paragraph (2)—

(a)omit the definition of “the Life Directive”;

(b)insert at the appropriate place—

““the Solvency 2 Directive” means Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II);”;

(c)in the definition of “insurance policy” for “Article 2 of the Life Directive, but excluding a contract of a kind referred to in Article 2(2)(c) or (d) of that Directive” substitute “ Article 2(3) of the Solvency 2 Directive, but excluding a contract of a kind referred to in Article 2(3)(b)(iii) or (iv) of that Directive ”;

(d)in the definition of “qualifying insurance policy” for “Annex I to the Life Directive” substitute “ Annex II to the Solvency 2 Directive ”.

Marginal Citations

M21S.I. 1997/94; relevant amending instruments are S.I. 2005/421 and 2006/141.

Individual Savings Account Regulations 1998U.K.

8.—(1) The Individual Savings Account Regulations 1998 M22 are amended as follows.

(2) In paragraph (1) of regulation 2 (interpretation) in the definition of “assurance undertaking” for “an assurance undertaking within the meaning of Article 2 of the Council Directive of 5th November 2002 concerning life assurance (No 2002/83)” substitute “ a direct life insurance undertaking within the meaning of Article 2 of Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) ”.

Marginal Citations

M22S.I. 1998/1870, amended by S.I. 2004/2996; there are other amending instruments but none is relevant.

Competition Act 1998 (Small Agreements and Conduct of Minor Significance) Regulations 2000U.K.

9. In paragraph 1 (interpretation) of the Schedule to the Competition Act 1998 (Small Agreements and Conduct of Minor Significance) Regulations 2000 M23 in the definition of “insurance undertaking” for the words from “the Annex to Council Directive (EEC) 73/239” to the end of the definition substitute “ Article 2 of or Annex 1 to, or a reinsurance undertaking carrying on the business of reinsurance under Directive 2009/138/EC of the European Parliament and Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II); ”.

Marginal Citations

M23S.I. 2000/262; relevant amending instruments are S.I. 2004/3379 and 2007/3253.

Competition Act 1998 (Determination of Turnover for Penalties) Order 2000U.K.

10. In paragraph 1 (interpretation) of Schedule 1 (applicable turnover) to the Competition Act 1998 (Determination of Turnover for Penalties) Order 2000 M24 in the definition of “insurance undertaking” for the words from “the Annex to Council Directive (EEC) 73/239” to the end of the definition substitute “ Article 2 of or Annex 1 to, or a reinsurance undertaking carrying on the business of reinsurance under Directive 2009/138/EC of the European Parliament and Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II); ”.

Marginal Citations

M24S.I. 2000/309; relevant amending instruments are S.I. 2004/3379 and 2007/3253.

Financial Services and Markets Act 2000 (Regulated Activities) Order 2001U.K.

11.—(1) The Financial Services and Markets Act 2000 (Regulated Activities) Order 2001 M25 is amended as follows.

(2) In article 3(1) (interpretation), in the definition of “contract of insurance”—

(a)in paragraph (e) for “article 1(2)(e) of the first life insurance directive (collective insurance etc.)” substitute “ Article 2(3)(b)(v) of the Solvency 2 Directive ”;

(b)in paragraph (f) for “article 1(3) of the first life insurance directive (social insurance)” substitute “ Article 2(3)(c) of the Solvency 2 Directive ”.

(3) In article 11(2) (community co-insurers) for “the Council Directive of 30 May 1978 on the co-ordination of laws, regulations and administrative provisions relating to Community co-insurance (No 78/473/EEC)” substitute “ Article 190 of the Solvency 2 Directive ”.

(4) In paragraph (2) of article 72A (information society services)—

(a)omit sub-paragraphs (a) and (b);

(b)insert at the end of paragraph (2) “ the insurance falls within the scope of the Solvency 2 Directive. ”.

(5) In Schedule 1 (contracts of insurance)—

(a)in paragraph VIII (collective insurance etc) for “article 1(2)(e) of the first life insurance directive” substitute “ Article 2(3)(b)(v) of the Solvency 2 Directive ”;

(b)in paragraph IX (social insurance) for “article 1(3) of the first life insurance directive” substitute “ Article 2(3)(c) of the Solvency 2 Directive ”.

Marginal Citations

M25S.I. 2001/544; relevant amending instruments are S.I. 2002/1776 and 2004/3379

The Financial Services and Markets Act 2000 (Disclosure of Confidential Information) Regulations 2001U.K.

12.—(1) The Financial Services and Markets Act 2000 (Disclosure of Confidential Information) Regulations 2001 M26 are amended as follows.

(2) In regulation 2 (interpretation)—

(a)at the appropriate place insert—

““competent authority” includes a supervisory authority within the meaning of Article 13(10) of the Solvency 2 Directive;”;

(b)for sub-paragraphs (c), (d) and (e) of the definition of “single market restrictions” substitute—

“(c)articles 64, 65, 66, 67, 68, 69, and 70 of the Solvency 2 Directive;”.

(3) In regulation 9(2) (disclosure by regulators or regulator workers to certain other persons)—

(a)for sub-paragraph (c) substitute—

“(c)article 66 of the Solvency 2 Directive;”;

(b)omit sub-paragraphs (d) and (f).

Marginal Citations

M26S.I. 2001/2188; relevant amending instruments are S.I. 2013/1773, 2013/3115 and 2014/3348.

Financial Services and Markets Act 2000 (EEA Passport Rights) Regulations 2001U.K.

13.—(1) The Financial Services and Markets Act 2000 (EEA Passport Rights) Regulations 2001 M27 are amended as follows.

(2) In regulation 1(2) (interpretation) in sub-paragraph (b) of the definition of “health insurance risks” for “the first sub-paragraph of Article 54(2) of the third non-life insurance directive” substitute “ Article 206(2) of the Solvency 2 Directive ”.

(3) In paragraph (e) of regulation 2(5) (establishment of a branch: contents of consent notice)—

(a)omit from “has” to the end;

(b)after “firm” insert “ covers the Solvency Capital Requirement calculated in accordance with Article 100 of the Solvency 2 Directive and the minimum capital requirement calculated in accordance with Article 129 of that directive. ”.

(4) In paragraph (3) of regulation 3 (provision of services: contents of a regulator's notice)—

(i)in sub-paragraph (a) for “Article 6 of the first non-life insurance directive or Article 6 of the first life insurance directive” substitute “ Article 14 of the Solvency 2 Directive ”;

(ii)in sub-paragraph (e)—

(aa)omit from “has” to the end;

(bb)after “firm” insert “ covers the Solvency Capital Requirement calculated in accordance with Article 100 of the Solvency 2 Directive and the minimum capital requirement calculated in accordance with Article 129 of that directive. ”.

(5) In regulations 13(1), 15(1) and 16(1) for “any of the insurance directives” substitute “ the Solvency 2 Directive ”.

(6) In regulation 19(2)(a) for “Article 2.1a of the reinsurance directive” substitute “ Article 13(7) of the Solvency 2 Directive ”.

Marginal Citations

M27S.I. 2001/2511; relevant amending instruments are S.I. 2004/1862, 2007/3253 and 2013/642

Financial Services and Markets Act 2000 (Law Applicable to Contracts of Insurance) Regulations 2001U.K.

14. In regulation 6 of the Financial Services and Markets Act 2000 (Law Applicable to Contracts of Insurance) Regulations 2001 M28 (choice of law) for “Council Directive 78/473/EEC on the coordination of laws, regulations and administrative provisions relating to Community co-insurance” substitute “ the Solvency 2 Directive ”.

Marginal Citations

M28S.I. 2001/2635, to which there are amendments not relevant to these Regulations.

The Financial Services and Markets Act 2000 (Control of Business Transfers) (Requirements on Applicants) Regulations 2001 (Article 39)U.K.

15. In regulation 2 of the Financial Services and Markets Act 2000 (Control of Business Transfers) (Requirements on Applicants) Regulations 2001 M29 (meaning of the commitment) for “Article 2 of the life assurance consolidation directive” substitute “ Article 2(3) of the Solvency 2 Directive ”.

Marginal Citations

M29S.I. 2001/3625, amended by S.I. 2004/3379; there are other amending instruments but none is relevant.

Enterprise Act 2002 (Merger Fees and Determination of Turnover) Order 2003U.K.

16.—(1) The Enterprise Act 2002 (Merger Fees and Determination of Turnover) Order 2003 M30 is amended as follows.

(2) In paragraph 1 (interpretation) of Schedule 1 (applicable turnover) in the definition of “insurance undertaking” for the words from “the Annex to Council Directive (EEC) 73/239” to the end of the definition substitute “ Article 2(3) or Annex I of Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II); ”.

Marginal Citations

M30S.I. 2003/1370, to which there are amendments not relevant to these Regulations.

Insurers (Reorganisation and Winding Up) Regulations 2004U.K.

17.—(1) The Insurers (Reorganisation and Winding Up) Regulations 2004 M31 are amended as follows.

(2) In regulation 2(1) (interpretation)—

(a)omit the following definitions—

(i)“the first non-life insurance directive”;

(ii)“life insurance directive”;

(iii)“the reorganisation and winding-up directive”;

(iv)“the third non-life insurance directive”;

(b)insert at the appropriate place—

““the Solvency 2 Directive” means Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II);”;

(c)in the definition of “branch” for “Article 1(b) of the life insurance directive or the third non-life insurance directive” substitute “ Article 268(1)(b) of the Solvency 2 Directive ”;

(d)in the definition of “directive reorganisation measure” for “Article 2(c) of the reorganisation and winding-up directive” substitute “ Article 268(1)(c) of the Solvency 2 Directive ”;

(e)in the definition of “directive winding up proceedings” for “Article 2(d) of the reorganisation and winding-up directive” substitute “ Article 268(1)(d) of the Solvency 2 Directive ”;

(f)for the definition of “EEA insurer” substitute—

““EEA insurer” means an insurance undertaking, other than a UK insurer, pursuing the activity of direct insurance (within the meaning of the Solvency 2 Directive) which has received authorisation under Article 14 or Article 162 of the Solvency 2 Directive from its home state regulator;”;

(g)for the definition of “EEA regulator” substitute—

““EEA regulator” means a supervisory authority (within the meaning of Article 13(10) of the Solvency 2 Directive) of an EEA State;”;

(h)for the definition of “home state regulator” substitute—

““home state regulator”, in relation to an EEA insurer, means the EEA regulator—

in the EEA State in which its head office is located; or

if it is a branch of a third-country insurance undertaking (within the meaning of Article 13(3) of the Solvency 2 Directive), the EEA State in which the branch was granted authorisation in accordance with Articles 145 to 149 of the Solvency 2 Directive;”.

(3) In regulation 5(6) (schemes of arrangement: EEA insurers)—

(a)in paragraph (a) for “Article 2(i) of the reorganisation and winding up directive” substitute “ Article 268(1)(e) of the Solvency 2 Directive ”;

(b)in paragraph (b) for “Article 2(j) of the reorganisation and winding up directive” substitute “ Article 268(1)(f) of the Solvency 2 Directive ”;

(c)in paragraph (c) for “Article 2(g) of the reorganisation and winding up directive” substitute “ Article 268(1)(a) of the Solvency 2 Directive ”.

(4) In regulation 6(6) (reorganisation measures and winding up proceedings in respect of EEA insurers effective in the United Kingdom) in the definition of “relevant EEA State” for “Article 4 of the life insurance directive or Article 6 of the first non-life insurance directive” substitute “ Article 14 or Article 162 of the Solvency 2 Directive ”.

(5) In regulation 17 (interpretation of Part 4)—

(a)in the definition of “composite insurer” for “article 18(2) of the life insurance directive” substitute “ Article 73(2) of the Solvency 2 Directive ”;

(b)in the definition of “general business assets” for “Article 18(3) of the life insurance directive” substitute “ Article 73(5) of the Solvency 2 Directive ”;

(c)in the definition of “long term business assets” for “Article 18(3) of the first life insurance directive” substitute “ Article 73(5) of the Solvency 2 Directive ”.

(6) In regulation 50 (disclosure of confidential information: third country insurers)—

(a)in paragraph (2) for “Article 30 of the reorganisation and winding up directive” substitute “ Article 296 of the Solvency 2 Directive ”;

(b)in paragraph (7) in the definition of “EEA administrator” and “EEA liquidator” for “the reorganisation and winding up directive” substitute “ Title IV of the Solvency 2 Directive ”.

Marginal Citations

M31S.I. 2004/353, to which there are amendments not relevant to these Regulations.

Child Trust Funds Regulations 2004U.K.

18.—(1) The Child Trust Funds Regulations 2004 M32 are amended as follows.

(2) In paragraph (1)(b) of regulation 2 (interpretation) in the definition of “assurance undertaking” for “has the meaning in Article 2 of the Council Directive of 5th November 2002 concerning life assurance (2002/83/EC)” substitute “ means a direct life insurance undertaking within the meaning of Article 2 of Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) ”.

Marginal Citations

Financial Conglomerates and Other Financial Groups Regulations 2004U.K.

19.—(1) The Financial Conglomerates and Other Financial Groups Regulations 2004 M33 are amended as follows.

(2) In paragraph (2) of regulation 1 (interpretation) in sub-paragraph (b) of the definition of “regulated entity” for the words from “Article 4 of Directive 2002/83/EC” to the end of the sub-paragraph substitute “ Article 13(1) of Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II)) or a third-country insurance undertaking (within the meaning of Article 13(3) of that Directive); ”.

(3) In paragraph (1)(c) of regulation 15 (extension of power to vary Part 4A permissions) for the words from “Article 8(2) or Annex I.1.B. of Directive 98/78/EC to the end of the sub-paragraph substitute “Articles 221, 245, 246 or 258(1) of Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II).”.

Marginal Citations

M33S.I. 2004/1862; relevant amending instruments are S.I. 2006/3221, 2007/126, 2010/2628, 2011/1613, 2013/3115, 2013/472 and 2013/3115.

Pension Protection Fund (Entry Rules) Regulations (Northern Ireland) 2005U.K.

20.—(1) The Pension Protection Fund (Entry Rules) Regulations (Northern Ireland) 2005 M34 are amended as follows.

(2) In regulation 1(2) (interpretation)—

(a)omit the following definitions—

(i)“the first non-life insurance directive”;

(ii)“the life insurance directive”;

(iii)“the third non-life insurance directive”;

(b)insert at the appropriate place—

““the Solvency 2 Directive” means Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II);”;

(c)in the definition of “EEA insurer” for the words from “(within the meaning of Article 2 of the life insurance directive” to the end of the definition substitute “ (as referred to in Article 2 of the Solvency 2 Directive) which has received authorisation under Article 14 of the Solvency 2 Directive from its home state regulator; ”;

(d)in the definition of “EEA regulator” for the words from “means a competent authority” to the end of the definition substitute “ means a supervisory authority (within the meaning of Article 13(10) of the Solvency 2 directive) of an EEA State; ”.

Marginal Citations

M34S.R. (NI) 2005 No 126, amended by S.R. (NI) 2009 No 126; there are other amending instruments but none is relevant.

Occupational Pension Schemes (Investment) Regulations (Northern Ireland) 2005U.K.

21.—(1) The Occupational Pension Schemes (Investment) Regulations (Northern Ireland) 2005 M35 are amended as follows.

(2) In regulation 1(2) (interpretation)—

(a)omit the definition of “the Life Directive”;

(b)insert at the appropriate place—

““the Solvency 2 Directive” means Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II);”;

(c)in the definition of “insurance policy” for “Article 2 of the Life Directive, but excluding a contract of a kind referred to in Article 2(2)(c) or (d) of that Directive” substitute “ Article 2(3) of the Solvency 2 Directive, but excluding a contract of a kind referred to in Article 2(3)(b)(iii) or (iv) of that Directive ”;

(d)in paragraph (b) of the definition of “qualifying insurance policy”—

(i)for “competent authorities” substitute “ supervisory authorities ”;

(ii)for “assurance” substitute “ life insurance ”;

(iii)for “Annex I to the Life Directive” substitute “ Annex II to the Solvency 2 Directive ”.

Marginal Citations

M35S.R. (NI) 2005 No 569, to which there are amendments not relevant to these Regulations.

Pension Protection Fund (Entry Rules) Regulations 2005U.K.

22.—(1) The Pension Protection Fund (Entry Rules) Regulations 2005 M36 are amended as follows.

(2) In regulation 1(3) (interpretation)—

(a)omit the following definitions—

(i)“the first non-life insurance directive”;

(ii)“the life insurance directive”;

(iii)“the third non-life insurance directive”;

(b)insert at the appropriate place—

““the Solvency 2 Directive” means Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II);”;

(c)in the definition of “EEA insurer” for the words from “(within the meaning of Article 2” to the end of the definition substitute “ (within the meaning of Article 2 of the Solvency 2 Directive) which has received authorisation under Article 14 of the Solvency 2 Directive from its home state regulator; ”;

(d)in the definition of “EEA regulator” for the words from “means a competent authority” to the end of the definition substitute “ means a supervisory authority (within the meaning of Article 13(10) of the Solvency 2 Directive) of an EEA state ”.

Marginal Citations

M36S.I. 2005/590 amended by S.I. 2009/451; there are other amending instruments but none is relevant.

Insurers (Reorganisation and Winding Up) (Lloyd's) Regulations 2005U.K.

23.—(1) The Insurers (Reorganisation and Winding Up) (Lloyd's) Regulations 2005 M37 are amended as follows.

(2) In regulation 2 (interpretation) in the definition of “the association of underwriters known as Lloyd's” for the words from “the First Council Directive of 24 July 1973” to the end of the definition substitute “ Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II); ”.

Marginal Citations

M37S.I. 2005/1998, to which there are amendments not relevant to these Regulations.

Occupational Pension Schemes (Investment) Regulations 2005U.K.

24.—(1) The Occupational Pension Schemes (Investment) Regulations 2005 M38 are amended as follows.

(2) In regulation 1(2) (interpretation)—

(a)omit the definition of the “the Life Directive”;

(b)insert at the appropriate place—

““the Solvency 2 Directive” means Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II);”;

(c)in the definition of “insurance policy” for “article 2 of the Life Directive, but excluding a contract of a kind referred to in article 2(2)(c) and (d) of that Directive” substitute “ Article 2(3) of the Solvency 2 Directive, but excluding a contract of a kind referred to in Article 2(3)(b)(iii) or (iv) of that Directive ”;

(d)in paragraph (b) of the definition of “qualifying insurance policy”—

(i)for “competent authorities” substitute “ supervisory authorities ”;

(ii)for “assurance” substitute “ life insurance ”;

(iii)for “Annex I to the Life Directive” substitute “ Annex II to the Solvency 2 Directive ”.

Marginal Citations

M38S.I. 2005/3378; relevant amending instruments are S.I. 2006/778 and 2013/472.

Money Laundering Regulations 2007U.K.

25.—(1) The Money Laundering Regulations 2007 M39 are amended as follows.

(2) In regulation 2 (interpretation)—

(a)omit the definition of “the life assurance consolidation directive”;

(b)insert at the appropriate place—

““the Solvency 2 Directive” means Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II);”;

(c)in regulation 3(3)(b) (application of the Regulations)—

(i)for “the life assurance consolidation directive” substitute “ the Solvency 2 Directive ”;

(ii)for “activities covered by that directive” insert “ any activities or operations referred to in Article 2(3) of that Directive ”.

Marginal Citations

M39S.I. 2007/2157, to which there are amendments not relevant to these Regulations.

Large and Medium-sized Companies and Groups (Accounts and Reports) Regulations 2008U.K.

26.—(1) The Large and Medium-sized Companies and Groups (Accounts and Reports) Regulations 2008 M40 are amended as follows.

(2) In paragraph 52(3) (long term provision) of Schedule 3 (insurance companies: companies act individual accounts) for “Directive 2002/83/EC of the European Parliament and of the Council of 5th November 2002 concerning life assurance” substitute “ Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) ”.

Marginal Citations

M40S.I. 2008/410, to which there are amendments not relevant to these Regulations.

Insurance Accounts Directive (Miscellaneous Insurance Undertakings) Regulations 2008U.K.

27.—(1) The Insurance Accounts Directive (Miscellaneous Insurance Undertakings) Regulations 2008 M41 are amended as follows.

(2) In regulation 2(4) (interpretation)—

(a)in paragraph (a) for “Council Directive 73/239/EEC by Article 3 of that Directive” substitute “ Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) by Article 7, 9(1), 9(2) or 10(1) of that Directive, or ”;

(b)omit paragraph (b).

Marginal Citations

M41S.I. 2008/565, to which there are amendments not relevant to these Regulations.

Payment Services Regulations 2009U.K.

28.—(1) The Payment Services Regulations 2009 M42 are amended as follows.

(2) In regulation 19(15) (safeguarding requirements) in the definition of “authorised insurer” for “Article 6 of the First Council Directive 73/239/EEC of 24th July 1973 on the business of direct insurance other than life insurance” substitute “ Article 14 of Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) to carry out non-life insurance activities as referred to in Article 2(2) of that Directive ”.

Marginal Citations

M42S.I. 2009/209, to which there are amendments not relevant to these Regulations.

Mutual Societies (Transfers) Order 2009U.K.

29.—(1) The Mutual Societies (Transfers) Order 2009 M43 is amended as follows.

(2) In article 19 (EEA mutual society)—

(a)in paragraph (3)—

(i)for sub-paragraph (a) substitute—

“(a)a direct life or non-life undertaking as referred to in Article 2 of Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) which is authorised under Article 14 of that Directive; or”;

(ii)in sub-paragraph (b)(ii) for “under either of the directives mentioned in sub-paragraph (a)” substitute “ under the Directive mentioned in sub-paragraph (a) as a direct life or non-life undertaking within the meaning of Article 2 of that Directive ”;

(b)omit paragraph (4).

Marginal Citations

M43S.I. 2009/509, to which there are amendments not relevant to these Regulations.

Financial Services and Markets Act 2000 (Controllers) (Exemption) Order 2009U.K.

30. In article 2 of the Financial Services and Markets Act 2000 (Controllers) (Exemption) Order 2009 (interpretation) M44—

(a)for sub-paragraphs (d) and (e) of the definition of “relevant UK authorised person” substitute—

“(d)an insurance undertaking which includes for the purposes of this Order a managing agent; or

(e)a reinsurance undertaking.”;

(b)at the appropriate place insert—

““managing agent” has the meaning given in article 3 of the Financial Services and Markets Act 2000 (Regulated Activities) Order 2001;”.

Marginal Citations

M44S.I. 2009/774, to which there are amendments not relevant to these Regulations.

Financial Services and Markets Act 2000 (Law Applicable to Contracts of Insurance) Regulations 2009U.K.

31.—(1) The Financial Services and Markets Act 2000 (Law Applicable to Contracts of Insurance) Regulations 2009 M45 are amended as follows.

(2) In regulation 5 (community co-insurers)—

(a)for “Council Directive 78/473/EEC on the coordination of laws, regulations and administrative provisions relating to Community insurance” substitute “ Article 190 of the Solvency 2 Directive ”;

(b)for “that Directive” substitute “ that Article ”.

Marginal Citations

Occupational and Personal Pension Schemes (Automatic Enrolment) Regulations (Northern Ireland) 2010U.K.

32.—(1) The Occupational and Personal Pension Schemes (Automatic Enrolment) Regulations (Northern Ireland) 2010 M46 are amended as follows.

(2) For regulation 35(2)(d) (further conditions applicable to automatic enrolment schemes) substitute—

“(d)Article 13(10) of Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II);”.

Marginal Citations

M46S.R. (NI) 2010 No 122, to which there are amendments not relevant to these Regulations.

Occupational and Personal Pension Schemes (Automatic Enrolment) Regulations 2010U.K.

33.—(1) The Occupational and Personal Pension Schemes (Automatic Enrolment) Regulations 2010 M47 are amended as follows.

(2) For regulation 35(2)(d) (further conditions applicable to automatic enrolment schemes) substitute—

“(d)Article 13(10) of Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II);”.

Marginal Citations

M47S.I. 2010/772, to which there are amendments not relevant to these Regulations.

Electronic Money Regulations 2011U.K.

34.—(1) The Electronic Money Regulations 2011 M48 are amended as follows.

(2) In regulation 22(3) (safeguarding option 2) in the definition of “authorised insurer” for “Article 6 of the First Council Directive 73/239/EEC of 24th July 1973 on the business of direct insurance other than life insurance” substitute “ Article 14 of Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) to carry out non-life insurance activities within the meaning of Article 2(2) of that Directive ”.

Marginal Citations

M48S.I. 2011/99, to which there are amendments not relevant to these Regulations.

Bank of England Act 1998 (Macro-prudential Measures) Order 2013U.K.

35.—(1) The Bank of England Act 1998 (Macro-prudential Measures) Order 2013 M49 is amended as follows.

(2) In article 1(2) (interpretation)—

(a)omit the following definitions—

(i)“first non-life directive”;

(ii)“life assurance consolidation directive”;

(iii)“reinsurance directive”;

(b)insert at the appropriate place—

““solvency 2 directive” means Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II);”;

(c)in the definition of “insurance undertaking” for “the first non-life directive or the life assurance consolidation directive” substitute “ the solvency 2 directive ”;

(d)in the definition of “reinsurance undertaking” for “Article 3 of the reinsurance directive” substitute “ Article 14 of the solvency 2 directive to pursue reinsurance activities within the meaning of Article 13(7) of that directive ”;

(e)in the definition of “third country insurance undertaking” for “in accordance with the first non-life directive or the life assurance consolidation directive” substitute “ as an insurance undertaking in accordance with Article 14 of the solvency 2 directive ”;

(f)in the definition of “third country reinsurance undertaking” for “in accordance with the reinsurance directive” substitute “ as a reinsurance undertaking in accordance with Article 14 of the solvency 2 directive ”.

Marginal Citations

M49S.I. 2013/644, to which there are amendments not relevant to these Regulations.

Enterprise Act 2002 (Mergers) (Interim Measures: Financial Penalties) (Determination of Control and Turnover) Order 2014U.K.

36.—(1) The Enterprise Act 2002 (Mergers) (Interim Measures: Financial Penalties) (Determination of Control and Turnover) Order 2014 M50 is amended as follows.

(2) In paragraph 1 of the Schedule (turnover of an enterprise: interpretation) in the definition of “insurance undertaking”—

(a)in paragraph (a) for “the Annex to Council Directive (EEC) 73/239 of 24th July 1973 on the coordination of laws, regulations and administrative provisions relating to the taking-up and pursuit of the business of direct insurance other than life assurance” substitute “ Annex I to Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) ”;

(b)in paragraph (b)—

(i)omit “direct”;

(ii)for “Article 2 of Directive 2002/83/EC of the European Parliament and of the Council of 5th November 2002 concerning life assurance” substitute “ Article 2(3) of Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) ”;

(c)in paragraph (c) for “Directive 2005/68/EC of the European Parliament and of the Council of 16th November 2005 on reinsurance” substitute “ Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) ”.

Marginal Citations

Regulation 35

SCHEDULE 3U.K.Parent undertakings outside the EEA: equivalence

1. This Schedule specifies the procedure for verifying whether the insurance undertaking or reinsurance undertaking referred to in regulation 35(1) is subject to supervision which is equivalent to that set out in Title 3 of the Solvency 2 Directive.U.K.

2. The PRA must follow the procedure set out in Flowchart 1 in order to determine whether—U.K.

(a)Article 19 of the EIOPA Regulation applies;

(b)the PRA must make the decision on equivalence;

(c)another supervisory authority will make the decision on equivalence; or

(d)the PRA must rely on equivalent group supervision exercised by the third country supervisory authorities.

3. Flowchart 1 also imposes duties and confers powers on the PRA for the purposes of making and giving effect to that determination.U.K.

4. Where reference is made to this paragraph in Flowchart 1, the PRA must—U.K.

(a)verify equivalence—

(i)at the level of the ultimate non-EEA solvency 2 parent where—

(aa)the Commission has adopted a delegated act under Article 260(3) of the Solvency 2 Directive; and

(bb)the parent undertaking is a subsidiary of an insurance holding company or a mixed financial holding company which has its head office in a third country, or of a third country insurance undertaking or third country reinsurance undertaking; or

(ii)in all other cases, either at the level of the ultimate non-EEA solvency 2 parent or at a lower level;

(b)where sub-paragraph (a)(ii) applies, explain its decision to the group to which the insurance undertaking or reinsurance undertaking belongs;

(c)consult the other supervisory authorities making up the college before making a decision on equivalence;

(d)ensure that its decision on equivalence does not contradict any previous decision taken in relation to the third country, except where it is necessary to do so in order to take into account significant changes to the supervisory regime in Title 3 of the Solvency 2 Directive or the third country; and

(e)take its decision on equivalence in accordance with the criteria set out in any delegated act made by the European Commission under Article 260(2) of the Solvency 2 Directive.

5. In this schedule, “acting group supervisor” means the supervisory authority acting as the group supervisor for the purposes of determining whether the insurance undertaking or reinsurance undertaking is subject to supervision which is equivalent to that set out in Title 3 of the Solvency 2 Directive.U.K.

Regulation 40

SCHEDULE 4U.K.Procedure for an application for a subsidiary to be subject to national law implementing Articles 238 and 239 of the Solvency 2 Directive

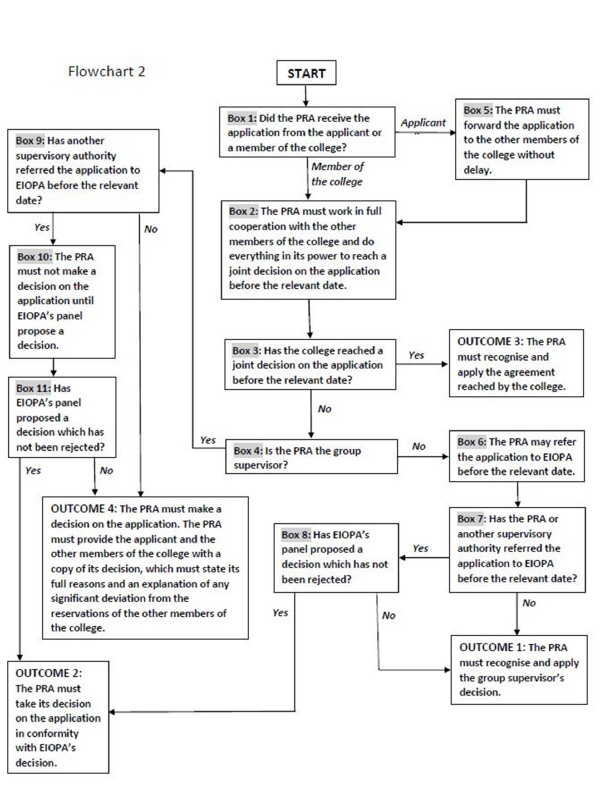

1. When the PRA receives an application referred to in the first row of Table 2, the PRA must follow the procedure set out in Flowchart 2 for the purposes of determining whether—U.K.

(a)the PRA must recognise and apply the group supervisor's decision on the application;

(b)the PRA must take its decision on the application in conformity with a decision made by EIOPA;

(c)the PRA must recognise and apply an agreement reached by the college of supervisors; or

(d)the PRA (as group supervisor) must take the decision on the application.

2. Flowchart 2 also imposes duties and confers powers on the PRA for the purposes of making and giving effect to that determination.U.K.

3. In Flowchart 2—U.K.

(a)“college” means the college of supervisory authorities;

(b)“relevant date” means the date falling immediately after the period of three months beginning with the date on which the complete application was received by the supervisory authority to which the application was made; and

(c)a reference to the panel's proposal being rejected is a reference to a proposal by EIOPA's panel being rejected in accordance with Articles 41(2) and (3), and 44(1), of the EIOPA Regulation.

Regulation 40

SCHEDULE 5U.K.Procedure for group applications

1. When the PRA receives a group application, the PRA must follow the procedure set out in Flowchart 3 for the purposes of determining whether—U.K.

(a)the PRA must recognise and apply the group supervisor's decision on the application;

(b)the PRA must take its decision on the application in conformity with a decision made by EIOPA;

(c)the PRA must recognise and apply an agreement reached by the college of supervisors; or

(d)the PRA (as group supervisor) must take the decision on the application.

2. Flowchart 3 also imposes duties and confers powers on the PRA for the purposes of making and giving effect to that determination.U.K.

3. In Flowchart 3—U.K.

(a)“college” means the college of supervisory authorities;

(b)“relevant date” means the date falling immediately after the period of six months beginning with the date on which the complete application was received by the supervisory authority to which the application was made; and

(c)a reference to the panel's proposal being rejected is a reference to a proposal by EIOPA's panel being rejected in accordance with Articles 41(2) and (3), and 44(1), of the EIOPA Regulation.

Options/Help

Print Options

PrintThe Whole Instrument

PrintThe Schedules only

Legislation is available in different versions:

Latest Available (revised):The latest available updated version of the legislation incorporating changes made by subsequent legislation and applied by our editorial team. Changes we have not yet applied to the text, can be found in the ‘Changes to Legislation’ area.

Original (As Enacted or Made): The original version of the legislation as it stood when it was enacted or made. No changes have been applied to the text.

Point in Time: This becomes available after navigating to view revised legislation as it stood at a certain point in time via Advanced Features > Show Timeline of Changes or via a point in time advanced search.

See additional information alongside the content

Geographical Extent: Indicates the geographical area that this provision applies to. For further information see ‘Frequently Asked Questions’.

Show Timeline of Changes: See how this legislation has or could change over time. Turning this feature on will show extra navigation options to go to these specific points in time. Return to the latest available version by using the controls above in the What Version box.

Explanatory Memorandum

Explanatory Memorandum sets out a brief statement of the purpose of a Statutory Instrument and provides information about its policy objective and policy implications. They aim to make the Statutory Instrument accessible to readers who are not legally qualified and accompany any Statutory Instrument or Draft Statutory Instrument laid before Parliament from June 2004 onwards.

More Resources

Access essential accompanying documents and information for this legislation item from this tab. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as enacted version that was used for the print copy

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- correction slips

- links to related legislation and further information resources

Impact Assessments

Impact Assessments generally accompany all UK Government interventions of a regulatory nature that affect the private sector, civil society organisations and public services. They apply regardless of whether the regulation originates from a domestic or international source and can accompany primary (Acts etc) and secondary legislation (SIs). An Impact Assessment allows those with an interest in the policy area to understand:

- Why the government is proposing to intervene;

- The main options the government is considering, and which one is preferred;

- How and to what extent new policies may impact on them; and,

- The estimated costs and benefits of proposed measures.

Timeline of Changes

This timeline shows the different points in time where a change occurred. The dates will coincide with the earliest date on which the change (e.g an insertion, a repeal or a substitution) that was applied came into force. The first date in the timeline will usually be the earliest date when the provision came into force. In some cases the first date is 01/02/1991 (or for Northern Ireland legislation 01/01/2006). This date is our basedate. No versions before this date are available. For further information see the Editorial Practice Guide and Glossary under Help.

More Resources

Use this menu to access essential accompanying documents and information for this legislation item. Dependent on the legislation item being viewed this may include:

- the original print PDF of the as made version that was used for the print copy

- correction slips

Click 'View More' or select 'More Resources' tab for additional information including:

- lists of changes made by and/or affecting this legislation item

- confers power and blanket amendment details

- all formats of all associated documents

- links to related legislation and further information resources